Conference Accounting Management System

CAMS is a Microsoft Excel spreadsheet application that was created specifically for use by Saint Vincent de Paul Conference Treasurers within the Greater Toronto Central Council. While not an official GTCC product, it is offered on an as-is basis to assist with conference records management. The CAMS download is password protected, which is provided to conference executives upon request. Requests should be sent to SSVP Tools.

DOWNLOAD THE CURRENT VERSION OF CAMS

- Current release of CAMS is Ver 12.09.05 11 Nov 2024

- CAMS should be downloaded annually to ensure compliance with CRA and Society requirements.

- CAMS runs with Excel 2000, 2002, 2003, 2007, 2010, 2013, Mac Excel 2011; Excel 2016

- If you are new to CAMS, remember to email SSVP Tools to request the password. Please include your name and which conference you are with when you make this request.

Useful information about CAMS:

- What’s new in CAMS this year

- What does CAMS look like?

- Not sure how to download?

- New to SSVP bookkeeping?

- Check out the Treasurer Support tab

Download the current version of PCAMS

Note: PCAMS is specifically for Particular Council use Only

Conference Treasurers should use CAMS

- Current release of PCAMS is Ver 12.09.05 11 Nov 2024

- CAMS should be downloaded annually to ensure compliance with CRA and Society requirements.

- PCAMS runs with Excel 2000, 2002, 2003, 2007, 2010, 2013, Mac Excel 2011; Excel 2016

- If you are new to PCAMS, remember to email SSVP Tools to request the password. Please include your name and which particular council you are with when you make this request.

Useful information about PCAMS:

- What’s new in PCAMS this year

- What does PCAMS look like?

- Not sure how to download?

- New to SSVP bookkeeping?

- Check out the Treasurer Support tab

Each year, new and existing treasurers within SSVP GTCC will receive an email inviting them to join our training and review sessions which cover Treasurer Duties, CAMS, and completing and filing the T3010.

Please review the following materials.

- Treasurer Role Description

- Treasurer Duties

- Be familiar with GTCC’s Policy 22

- Ensure that no contracts, agreements, undertakings are signed without first reviewing the details with GTCC, including but not limited to bequests, stock transfers, and significant financial gifts.

- SSVP Bookkeeping Basics

- CRA Requirements

- Gifts in Kind

- Bank Reconciliation using CAMS

If you require more support about CAMS, please email SSVP Tools and include your name, the conference or particular council you are with, which version is installed on your computer, and a description of the issue, wording of error messages, screenshots, etc.

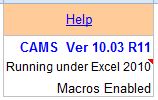

The CAMS version can be found on the Main Menu in the version message block.

Guides and FAQS

For those new to CAMS, we offer the following guides:

- FAQ for CAMS

- System Overview for CAMS

- Excel and Microsoft Office Explained

- How to Download and Install CAMS

- Opening CAMS after downloading

- Macros in Excel

- Snipping Tool and Windows Explorer

- The Differences between CAMS and PCAMS (see below)

The treasurer’s guidelines from SSVP GTCC incorporate directives set out by the Charities Directorate of the Canada Revenue Agency.

The CRA website has numerous resources to assist Canadian charities in understanding requirements for record keeping, reporting and donation processing.

Some useful references:

Accordion

The Excel-based systems CAMS (Conference Accounting Management System) and PCAMS (Particular Council Accounting Management System) are very similar in design, with the following differences:

- PCAMS has two supplementary analysis sheets which tally council revenues and expenditures involving its reporting conferences.

- The Analysis of Contributions sheet tallies funds remitted to the council from its conferences (gift from a Registered Charity), and funds allotted by the council to conferences in need (gift to a Qualified Donee).

- The Analysis of Stores sheet tallies invoiced amounts from warehouse and stores operations paid by the council on behalf of conferences versus conference reimbursement of same.

- Since councils typically do not have a significant donor group PCAMS does not support Donor name and address list Import / Export

- PCAMS has an optional feature that allows for tracking the balance of two bank accounts (typically a chequing account and a savings-type account).

- CAMS supports transactions for cash-equivalent assets such as purchase of gift cards / prepaid vouchers

- Classification of Revenues and Expenditures. The allowed classification of Revenues and Expenditures in PCAMS reflects the differences in revenue sources and expenditure types involved at the particular council level. This affects the classification columns of the Revenues and Expenditures worksheets, with corresponding impact on the structure / format of the monthly Book Balances worksheet and the Annual Financial Statement as required by CRA.

The detail system of accounts for CAMS and PCAMS are as follows:

Expenditures

| CAMS | PCAMS |

| (4800) Advertising & Fund Raising | (4800) Advertising & Fund Raising |

| (4810) Travel Expense | (4810) Travel Expense |

| (4810) Vehicle Expense | (4810) Vehicle Expense |

| (4820) Bank Charges | (4820) Bank Charges |

| (4840) Office Expense | (4840) Office Expense |

| (4860) Professional & Consulting | (4860) Professional & Consulting |

| (4870) Education & Training | (4870) Education & Training |

| (4890) Charitable Works | (4890) Charitable Works |

| (4890) Vouchers Paid to Particular Council | |

| (4920) Sundry Expenses | (4920) Sundry Expenses |

| (5050) Particular Council | (5050) Conference |

| (5050) Central Council | |

| (5050) National Council Twinning | (5050) National Council Twinning |

Revenues

| CAMS | PCAMS |

| (4500) Donations | (4500) Donations |

| (4500) Bequests | (4500) Bequests |

| (4510) Particular Council | |

| (4510) Conference Contributions | |

| (4510) Other Reg’d Charities | (4510) Other Reg’d Charities |

| (4530) Poor Box Collections | (4530) Poor Box Collections |

| (4530) Secret Collection | (4530) Secret Collection |

| (4570) Grants | (4570) Grants |

| (4580) Bank Interest | (4580) Bank Interest |

| (4630) Fund Raising | (4630) Fund Raising |

| (4640) Sale of Goods and Svcs | (4640) Sale of Goods and Svcs |

| (4650) Sundry Income | (4650) Sundry Income |